Renters Insurance in and around Fowlerville

Your renters insurance search is over, Fowlerville

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Trying to sift through deductibles and coverage options on top of managing your side business, work and your pickleball league, can be overwhelming. But your belongings in your rented property may need the remarkable coverage that State Farm provides. So when mishaps occur, your videogame systems, swing sets and souvenirs have protection.

Your renters insurance search is over, Fowlerville

Renters insurance can help protect your belongings

There's No Place Like Home

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help protect your belongings. But take a moment to think about what it would cost to replace all the personal property in your rented townhome. State Farm's Renters insurance can help when windstorms or tornadoes damage your stuff.

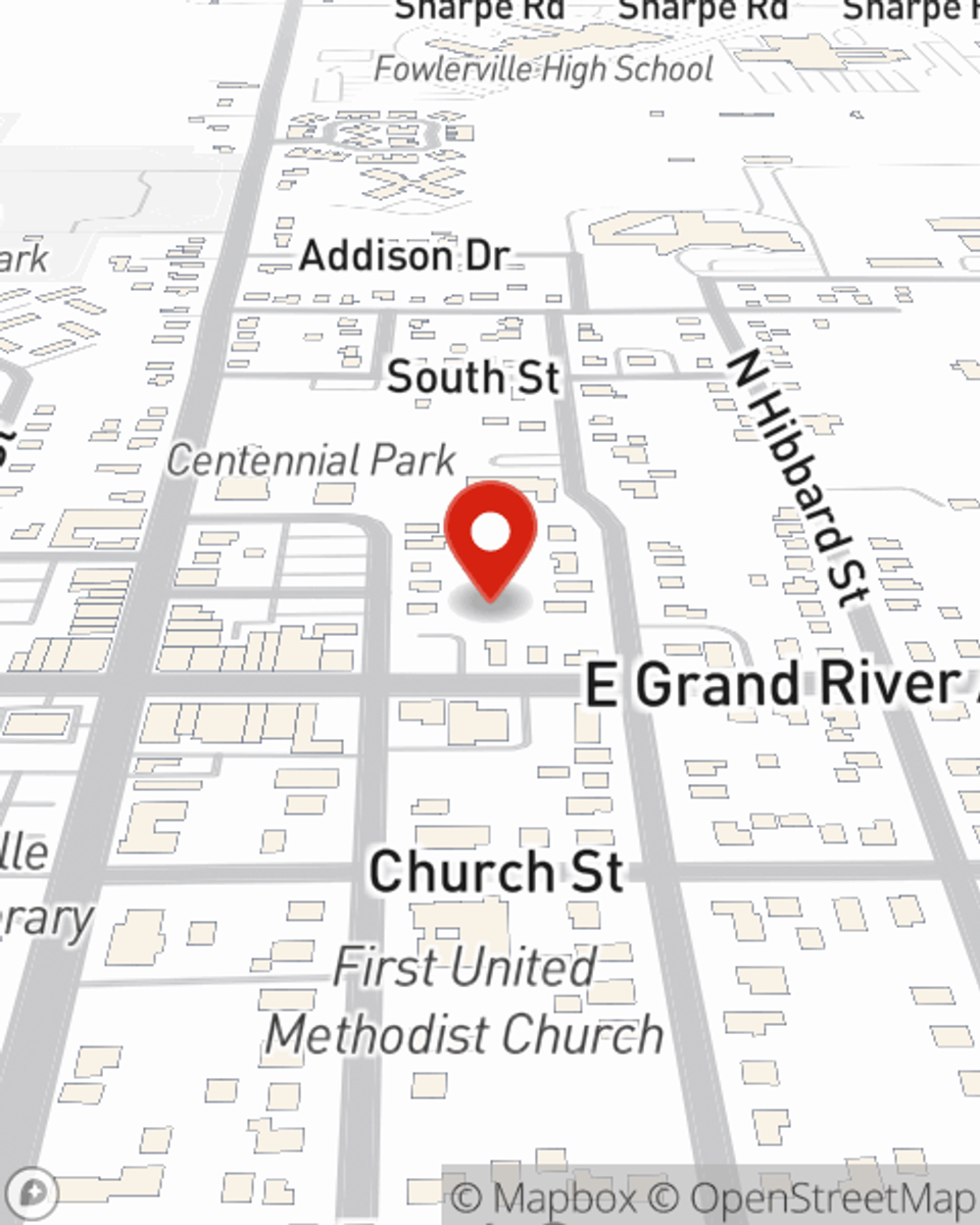

If you're looking for a value-driven provider that offers a free quote on a renters policy, visit State Farm agent Katie Pikkarainen today.

Have More Questions About Renters Insurance?

Call Katie at (517) 223-4173 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Katie Pikkarainen

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.